2021/0616

白銀/標準普爾 500 指數即將出現的逆轉將令人震驚

The Coming Reversal in the Silver/S&P 500 Ratio Will Be Shocking

白銀/標準普爾 500 指數即將出現的逆轉將令人震驚!

By Jeff Clark , 2021/6/15

The stock market bubble continues to inflate, while the price of silver remains range-bound. But a reversal in those two asset classes is coming, and based on history it could be one for the record books. In fact, you might want to refrain from sipping hot coffee while viewing the tables below…

股市泡沫繼續膨脹,而白銀價格仍保持區間震盪。但是這兩種資產類別的逆轉即將到來,根據歷史,它可能會成為記錄簿中的一種。事實上,您可能希望在查看下表時不要啜飲熱咖啡……

Back to the Future for Silver and Stocks

回到白銀和股票的未來

To the surprise of many mainstream investors, silver outperformed all major stock indexes last year. It’s more than doubled since the selloff in March 2020. It’s up 6% in 2021.

令許多主流投資者感到意外的是,白銀去年的表現跑贏了所有主要股指。自 2020 年 3 月的拋售以來,它已經翻了一番多。 2021 年上漲了 6%。

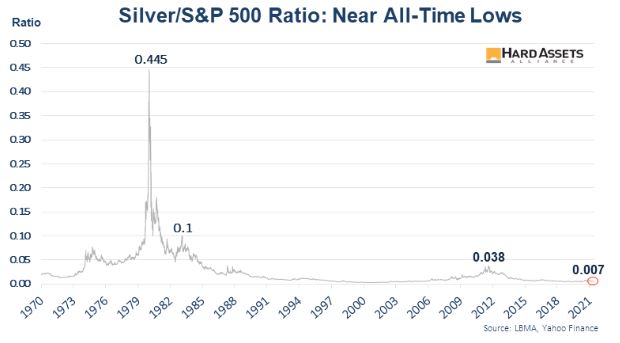

Yet compared to the general stock market, silver is, believe it or not, still near its all-time low.

然而,與一般股市相比,不管你信不信,白銀仍接近歷史低點。

The rise in the silver price over the past year has done virtually nothing to improve this ratio. In fact…

過去一年白銀價格的上漲幾乎沒有改善這一比率。實際上…

Only at the beginning of the new millennia has this ratio been lower than it is right now.

只是在新千年開始時,這個比率才低於現在。

You can see where it has peaked in the past. Compared to today, the ratio was…

你可以看到它過去在哪里達到頂峰。與今天相比,這個比例是……

• 4.4 times higher in 2011

• 13.3 times higher in 1983

• And a whopping 62.5 times higher in 1980!

• 2011 年增長 4.4 倍

• 1983 年高出 13.3 倍

• 1980 年高達 62.5 倍!

The point here is obvious. If history were to repeat and the ratio returned to any of these prior levels, it means stocks are headed lower (and probably by a lot), while silver would climb (and probably by a lot). Sure, since it’s a ratio only one of those things could happen while the other stays stagnant, but the more likely scenario is they both move.

這裡的重點是顯而易見的。如果歷史重演並且該比率回到這些先前水平中的任何一個,則意味著股票走低(並且可能大幅下跌),而白銀將攀升(並且可能大幅上漲)。當然,由於這是一個比率,因此只有其中一件事情會發生,而另一件事情則停滯不前,但更有可能的情況是它們都發生了變化。

And because the ratio is near historic lows, the reversal is likely to be, well, breathtaking.

而且由於該比率接近歷史低點,逆轉很可能是驚人的。

How breathtaking?

有多驚人?

Why, I’m glad you asked...

為何? 我很慶幸你這麼問

Thrills for Silver, Chills for Stocks

白銀的興奮,股票的寒意

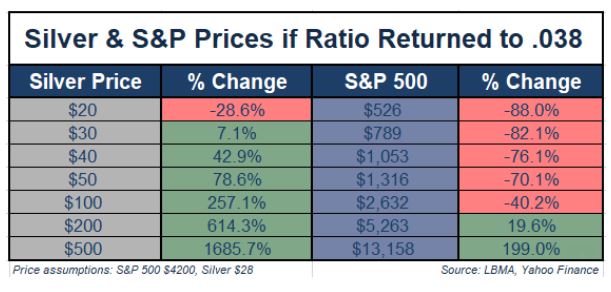

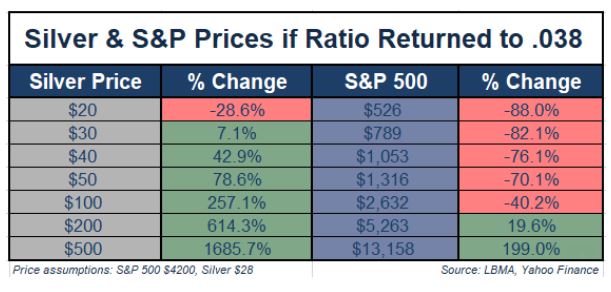

The following tables show what would happen to the prices of silver and the S&P 500 if the three ratios above were to be hit from current levels. To keep it simple, the tables are calculated from 4,200 for the S&P and $28 for silver.

下表顯示瞭如果上述三個比率從當前水平受到衝擊,白銀和標準普爾 500 指數的價格會發生什麼變化。為簡單起見,這些表格是根據標準普爾指數的 4,200點 和白銀的 28 美元計算得出的。

First, if the ratio returned to its 2011 high of .038, here are various prices for silver and the S&P 500 we could see.

首先,如果該比率回到 0.038 的 2011 年高點,我們可以看到白銀和標準普爾 500 指數的各種價格。

The silver price would have to approach $200 before the S&P 500 would avoid any losses.

在標準普爾 500 指數避免任何損失之前,白銀價格必須接近 200 美元。

If silver hit $100, it would represent a rise of 257%, while the S&P would lose 40%. If silver hit $500 the S&P would nearly triple from current levels, but that would mean silver would rise almost 17 times from its present price.

如果白銀達到 100 美元,它將上漲 257%,而標準普爾指數將下跌 40%。如果白銀達到 500 美元,標準普爾指數將從當前水平上漲近兩倍,但這意味著白銀將比當前價格上漲近 17 倍。

All this on just a return to the 2011 ratio, which is where we were in the last bull market and the lowest peak in the chart above.

所有這一切只是為了回到 2011 年的比率,這是我們在上一次牛市中的位置,也是上圖中的最低點。

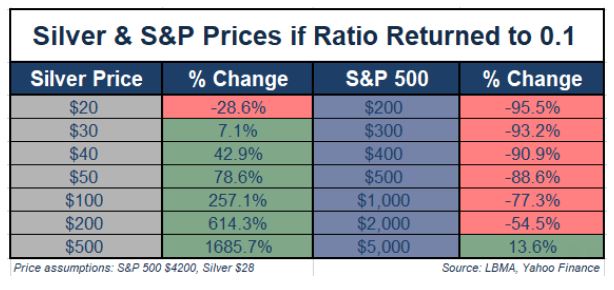

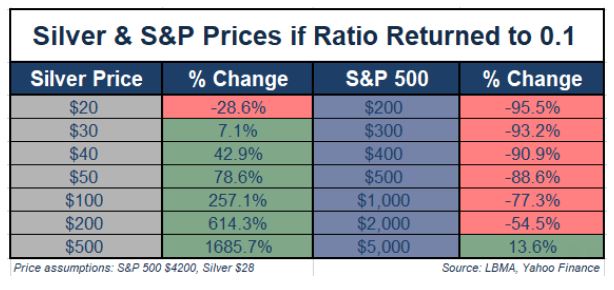

While this scenario is sobering, it only gets worse for stock investors. Here’s what silver and S&P prices would look like if the ratio matched its 1983 high of 0.1.

雖然這種情況令人警醒,但對股票投資者來說只會變得更糟。如果該比率與 1983 年 0.1 的高點相匹配,那麼白銀和標準普爾的價格將如下所示。

At this ratio, stock investors would only see a gain if silver climbs to $500—in all other scenarios they lose, and in most cases dramatically.

按照這個比率,股票投資者只會在白銀攀升至 500 美元時看到收益——在所有其他情況下,他們都會虧損,並且在大多數情況下會大幅虧損。

A $200 silver price would mean the S&P falls by over half. This isn’t farfetched, since again, this ratio has occurred before—and $200 silver wouldn’t even match the 1979-1980 advance of 743%.

200 美元的白銀價格意味著標準普爾指數下跌一半以上。這並不牽強,因為這個比例之前也曾出現過——200 美元的白銀甚至無法與 1979-1980 年 743% 的漲幅相提並論。

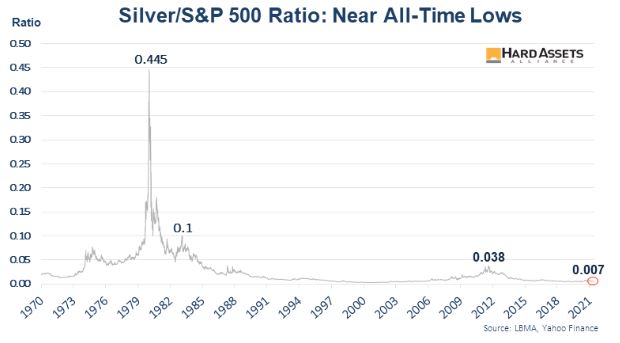

And now it’s time to set your coffee cup down… a rematch of the 1980 high of .445.

現在是時候放下你的咖啡杯了……這是 1980 年高點 0.445 的複盤。

This is nothing short of a complete wipeout of the broad stock market.

這簡直就是對整個股市的徹底毀滅。

Even a $500 silver price leaves S&P investors losing 74% of their stock portfolio. At this ratio the silver price would have to rise to over $2,000 an ounce before the S&P registers no loss.

即使白銀價格為 500 美元,標準普爾投資者也會損失 74% 的股票投資組合。按照這個比率,白銀價格必須升至每盎司 2,000 美元以上,標準普爾才沒有虧損。

Regardless of their prices, silver would outperform the S&P 500 by over 62 times to return to this ratio.

無論價格如何,白銀的表現都將超過標準普爾 500 指數的 62 倍,以恢復到這一比率。

Remember, these are not pretend prices, model projections, or wishful thinking on the part of silver bugs. All these ratios have occurred before.

請記住,這些不是虛假價格、模型預測或銀臭蟲(意旨:白銀投資者)的一廂情願。所有這些比率以前都發生過。

And given where the ratio currently sits, the odds of it moving significantly higher are indeed very strong.

考慮到該比率目前所處的位置,它大幅走高的可能性確實非常大。

• When the silver/S&P 500 ratio begins to reverse, stock losses will mount and silver’s gains will grow. Based on history the moves will probably be substantial for both sets of investors.

• 當白銀/標準普爾 500 指數開始反轉時,股票損失將增加,白銀的收益將增加。根據歷史,這對兩組投資者來說都可能是重大的舉措。

And here’s something to think about: once the reversal in this ratio picks up steam, how do you think the average investor reacts? Would they dump at least some of their stocks and shift to silver?

這裡有一些事情需要考慮:一旦這個比率的逆轉加速,你認為普通投資者會如何反應?他們會拋售至少部分股票並轉向白銀嗎?

Throw in the fact that the average investor crowds in near the end and this reversal could get some serious momentum.

考慮到普通投資者在接近尾聲時蜂擁而至,這種逆轉可能會獲得一些嚴重的動力。

Stock-only Investors: How Lucky Do You Feel?

只做股票的投資者:你覺得有多幸運?

So silver-less investors, I’ll use a famous movie line to ask an honest question: do you feel lucky?

所以沒有投資白銀的投資者,我會用一個著名的電影台詞來問一個誠實的問題:你覺得幸運嗎?

If you remain in stocks and have no exposure to silver, I hope you’re not one of those that end up selling your losing stock positions near their bottom and buying silver near its top, indirectly helping me and my silver friends become richer.

如果你繼續持有股票並且沒有接觸白銀,我希望你不是那些最終在接近底部賣出虧損股票頭寸並在接近頂部買入白銀的人之一,間接幫助我和我的白銀朋友變得更富有。

Or instead, given that stocks don’t run up forever, and that silver is deeply undervalued on a relative basis and will almost certainly rise over the next few years, might it be wise to allocate a portion of your portfolio to silver now?

或者相反,鑑於股票不會永遠上漲,而且白銀相對而言被嚴重低估,並且幾乎肯定會在未來幾年上漲,現在將一部分投資組合分配給白銀是否明智?

Just don’t wait too long, as silver tends to spike suddenly and violently.

只是不要等待太久,因為白銀往往會突然猛烈地飆升。

If you don’t own any silver, I encourage you to buy some now. At the current ratio, your risk is very low.

如果你沒有白銀,我鼓勵你現在買一些。按照目前的比率,您的風險非常低。

And if you don’t buy silver now? Well, if we get the wealth transfer we believe is coming, you’ll either be a victim or victor.

如果你現在不投資白銀?好吧,如果我們得到我們認為即將到來的財富轉移,你要么成為受害者,要么成為勝利者。

Given where this ratio sits, silver investors are destined to be the victors.

鑑於這個比率所在,白銀投資者註定是勝利者。

Regards,

Jeff Clark

Senior Analyst

Shiny黃金白銀交易所

引用: Jeff Clark for Hard Assets Alliance

*文章內容為筆者個人見解,僅供參考。恕不代表本站立場

白銀/標準普爾 500 指數即將出現的逆轉將令人震驚!

By Jeff Clark , 2021/6/15

The stock market bubble continues to inflate, while the price of silver remains range-bound. But a reversal in those two asset classes is coming, and based on history it could be one for the record books. In fact, you might want to refrain from sipping hot coffee while viewing the tables below…

股市泡沫繼續膨脹,而白銀價格仍保持區間震盪。但是這兩種資產類別的逆轉即將到來,根據歷史,它可能會成為記錄簿中的一種。事實上,您可能希望在查看下表時不要啜飲熱咖啡……

Back to the Future for Silver and Stocks

回到白銀和股票的未來

To the surprise of many mainstream investors, silver outperformed all major stock indexes last year. It’s more than doubled since the selloff in March 2020. It’s up 6% in 2021.

令許多主流投資者感到意外的是,白銀去年的表現跑贏了所有主要股指。自 2020 年 3 月的拋售以來,它已經翻了一番多。 2021 年上漲了 6%。

Yet compared to the general stock market, silver is, believe it or not, still near its all-time low.

然而,與一般股市相比,不管你信不信,白銀仍接近歷史低點。

The rise in the silver price over the past year has done virtually nothing to improve this ratio. In fact…

過去一年白銀價格的上漲幾乎沒有改善這一比率。實際上…

Only at the beginning of the new millennia has this ratio been lower than it is right now.

只是在新千年開始時,這個比率才低於現在。

You can see where it has peaked in the past. Compared to today, the ratio was…

你可以看到它過去在哪里達到頂峰。與今天相比,這個比例是……

• 4.4 times higher in 2011

• 13.3 times higher in 1983

• And a whopping 62.5 times higher in 1980!

• 2011 年增長 4.4 倍

• 1983 年高出 13.3 倍

• 1980 年高達 62.5 倍!

The point here is obvious. If history were to repeat and the ratio returned to any of these prior levels, it means stocks are headed lower (and probably by a lot), while silver would climb (and probably by a lot). Sure, since it’s a ratio only one of those things could happen while the other stays stagnant, but the more likely scenario is they both move.

這裡的重點是顯而易見的。如果歷史重演並且該比率回到這些先前水平中的任何一個,則意味著股票走低(並且可能大幅下跌),而白銀將攀升(並且可能大幅上漲)。當然,由於這是一個比率,因此只有其中一件事情會發生,而另一件事情則停滯不前,但更有可能的情況是它們都發生了變化。

And because the ratio is near historic lows, the reversal is likely to be, well, breathtaking.

而且由於該比率接近歷史低點,逆轉很可能是驚人的。

How breathtaking?

有多驚人?

Why, I’m glad you asked...

為何? 我很慶幸你這麼問

Thrills for Silver, Chills for Stocks

白銀的興奮,股票的寒意

The following tables show what would happen to the prices of silver and the S&P 500 if the three ratios above were to be hit from current levels. To keep it simple, the tables are calculated from 4,200 for the S&P and $28 for silver.

下表顯示瞭如果上述三個比率從當前水平受到衝擊,白銀和標準普爾 500 指數的價格會發生什麼變化。為簡單起見,這些表格是根據標準普爾指數的 4,200點 和白銀的 28 美元計算得出的。

First, if the ratio returned to its 2011 high of .038, here are various prices for silver and the S&P 500 we could see.

首先,如果該比率回到 0.038 的 2011 年高點,我們可以看到白銀和標準普爾 500 指數的各種價格。

The silver price would have to approach $200 before the S&P 500 would avoid any losses.

在標準普爾 500 指數避免任何損失之前,白銀價格必須接近 200 美元。

If silver hit $100, it would represent a rise of 257%, while the S&P would lose 40%. If silver hit $500 the S&P would nearly triple from current levels, but that would mean silver would rise almost 17 times from its present price.

如果白銀達到 100 美元,它將上漲 257%,而標準普爾指數將下跌 40%。如果白銀達到 500 美元,標準普爾指數將從當前水平上漲近兩倍,但這意味著白銀將比當前價格上漲近 17 倍。

All this on just a return to the 2011 ratio, which is where we were in the last bull market and the lowest peak in the chart above.

所有這一切只是為了回到 2011 年的比率,這是我們在上一次牛市中的位置,也是上圖中的最低點。

While this scenario is sobering, it only gets worse for stock investors. Here’s what silver and S&P prices would look like if the ratio matched its 1983 high of 0.1.

雖然這種情況令人警醒,但對股票投資者來說只會變得更糟。如果該比率與 1983 年 0.1 的高點相匹配,那麼白銀和標準普爾的價格將如下所示。

At this ratio, stock investors would only see a gain if silver climbs to $500—in all other scenarios they lose, and in most cases dramatically.

按照這個比率,股票投資者只會在白銀攀升至 500 美元時看到收益——在所有其他情況下,他們都會虧損,並且在大多數情況下會大幅虧損。

A $200 silver price would mean the S&P falls by over half. This isn’t farfetched, since again, this ratio has occurred before—and $200 silver wouldn’t even match the 1979-1980 advance of 743%.

200 美元的白銀價格意味著標準普爾指數下跌一半以上。這並不牽強,因為這個比例之前也曾出現過——200 美元的白銀甚至無法與 1979-1980 年 743% 的漲幅相提並論。

And now it’s time to set your coffee cup down… a rematch of the 1980 high of .445.

現在是時候放下你的咖啡杯了……這是 1980 年高點 0.445 的複盤。

This is nothing short of a complete wipeout of the broad stock market.

這簡直就是對整個股市的徹底毀滅。

Even a $500 silver price leaves S&P investors losing 74% of their stock portfolio. At this ratio the silver price would have to rise to over $2,000 an ounce before the S&P registers no loss.

即使白銀價格為 500 美元,標準普爾投資者也會損失 74% 的股票投資組合。按照這個比率,白銀價格必須升至每盎司 2,000 美元以上,標準普爾才沒有虧損。

Regardless of their prices, silver would outperform the S&P 500 by over 62 times to return to this ratio.

無論價格如何,白銀的表現都將超過標準普爾 500 指數的 62 倍,以恢復到這一比率。

Remember, these are not pretend prices, model projections, or wishful thinking on the part of silver bugs. All these ratios have occurred before.

請記住,這些不是虛假價格、模型預測或銀臭蟲(意旨:白銀投資者)的一廂情願。所有這些比率以前都發生過。

And given where the ratio currently sits, the odds of it moving significantly higher are indeed very strong.

考慮到該比率目前所處的位置,它大幅走高的可能性確實非常大。

• When the silver/S&P 500 ratio begins to reverse, stock losses will mount and silver’s gains will grow. Based on history the moves will probably be substantial for both sets of investors.

• 當白銀/標準普爾 500 指數開始反轉時,股票損失將增加,白銀的收益將增加。根據歷史,這對兩組投資者來說都可能是重大的舉措。

And here’s something to think about: once the reversal in this ratio picks up steam, how do you think the average investor reacts? Would they dump at least some of their stocks and shift to silver?

這裡有一些事情需要考慮:一旦這個比率的逆轉加速,你認為普通投資者會如何反應?他們會拋售至少部分股票並轉向白銀嗎?

Throw in the fact that the average investor crowds in near the end and this reversal could get some serious momentum.

考慮到普通投資者在接近尾聲時蜂擁而至,這種逆轉可能會獲得一些嚴重的動力。

Stock-only Investors: How Lucky Do You Feel?

只做股票的投資者:你覺得有多幸運?

So silver-less investors, I’ll use a famous movie line to ask an honest question: do you feel lucky?

所以沒有投資白銀的投資者,我會用一個著名的電影台詞來問一個誠實的問題:你覺得幸運嗎?

If you remain in stocks and have no exposure to silver, I hope you’re not one of those that end up selling your losing stock positions near their bottom and buying silver near its top, indirectly helping me and my silver friends become richer.

如果你繼續持有股票並且沒有接觸白銀,我希望你不是那些最終在接近底部賣出虧損股票頭寸並在接近頂部買入白銀的人之一,間接幫助我和我的白銀朋友變得更富有。

Or instead, given that stocks don’t run up forever, and that silver is deeply undervalued on a relative basis and will almost certainly rise over the next few years, might it be wise to allocate a portion of your portfolio to silver now?

或者相反,鑑於股票不會永遠上漲,而且白銀相對而言被嚴重低估,並且幾乎肯定會在未來幾年上漲,現在將一部分投資組合分配給白銀是否明智?

Just don’t wait too long, as silver tends to spike suddenly and violently.

只是不要等待太久,因為白銀往往會突然猛烈地飆升。

If you don’t own any silver, I encourage you to buy some now. At the current ratio, your risk is very low.

如果你沒有白銀,我鼓勵你現在買一些。按照目前的比率,您的風險非常低。

And if you don’t buy silver now? Well, if we get the wealth transfer we believe is coming, you’ll either be a victim or victor.

如果你現在不投資白銀?好吧,如果我們得到我們認為即將到來的財富轉移,你要么成為受害者,要么成為勝利者。

Given where this ratio sits, silver investors are destined to be the victors.

鑑於這個比率所在,白銀投資者註定是勝利者。

Regards,

Jeff Clark

Senior Analyst

Shiny黃金白銀交易所

引用: Jeff Clark for Hard Assets Alliance

*文章內容為筆者個人見解,僅供參考。恕不代表本站立場